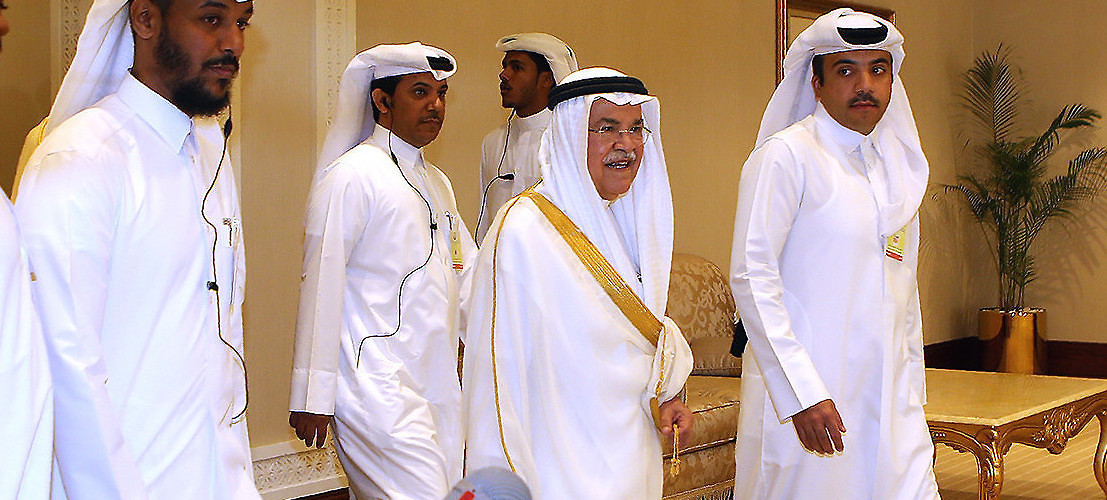

Saudi Arabian Minister of Oil and Mineral Resources, Ali al-Naimi (center) arrives at a recent OPEC meeting. Doha, Qatar, April 17, 2016. (Karim Jaafar/AFP/Getty Images)

Doubts persist on the strength of the United States-Saudi Arabia relationship after President Barack Obama’s visit to the Middle East last week. The alliance has been tested by shifting oil market dynamics, regional conflicts, and the resurgence of the Saudis’ main rival, Iran. As the US heads toward a presidential election whose candidates have divergent positions on managing these tensions, Saudi leaders are growing anxious in the face of their increasingly limited set of foreign policy options.

Obama’s trip was effectively designed to shore up Saudi ties, which have been undermined by an increasing US self-reliance on domestic oil reserves and Washington’s role in empowering Tehran through last year’s nuclear deal. Meanwhile, a bipartisan bill before Congress would allow US nationals to sue Saudi Arabia for its alleged involvement in the 9/11 attacks. It came as no surprise then when Saudi Arabia’s King Salman failed to meet Obama on his arrival in Riyadh as is customary, despite having earlier greeted Gulf Cooperation Council leaders with whom they were both attending a meeting.

A resurgent Iran has benefited from the nuclear deal and an improved relationship with the US under Obama. This has frustrated Arab Gulf states, which continue to feel the pressure from Tehran’s involvement in conflicts across the region in Yemen, Syria, and Iraq. Iran also has a perceived negative influence in Bahrain and Lebanon, where the Revolutionary Guard is making inroads.

Sanctions relief offered from January this year as part of the nuclear deal has been a major boon to Iran. Foreign investors are clamoring to enter the country’s $400 billion USD economy, and billions of dollars of previously frozen assets are set to be regained. Iran will also benefit from renewed oil sales on the global market, even in its depressed state. Iran can in turn make a dent in the market share of other leading producers. The short-term impact will be strongest on Saudi Arabia, as it sees its influence in the region threatened. This anxiety increased after an OPEC-initiated meeting of global oil producers in Qatar on April 17th. The meeting failed to reach an agreement that would have frozen output and thus increased prices. Iran was the main stumbling block, refusing to send a delegation and announcing that it would not be party to any agreement until it had recovered its pre-sanctions market share. The next OPEC meeting in June is not slated to achieve any noteworthy gains.

Meanwhile, November’s election is set to determine US policy in the Middle East until 2021 and will be watched closely by states across the region. Of particular interest have been the candidates’ positions on the Iran deal. The remaining Republicans, including Ted Cruz and Donald Trump, have been adamant that it is a bad deal for the US and its ally Israel. They have threatened to rescind the agreement should they come to power. The remaining Democrats, Hillary Clinton and Bernie Sanders, have placed their support behind the Obama administration and the deal and are likely to continue supporting its tenets. Nonetheless, all candidates can be expected to seek to improve the relationship between the US and its key regional allies, including Saudi Arabia and Israel, should they come to power.

In the interim, Saudi Arabia will look on anxiously as Iran grows in strength. As well as gaining economically, Tehran is making gains in the various proxy battles it is fighting with Riyadh. In Yemen, the Saudi-led coalition achieved its goal in 2015 of preventing a pro-Iran Houthi takeover of the state, but it has failed to take the capital, Sana’a. This has forced it to the negotiation table and it is likely that any future agreement will include provisions for increasing Houthi influence beyond what the group enjoyed prior to its 2014 breakout. On the economic front, Saudi Arabia’s inability to reign Iran into a deal will be balanced by attempts to build on its historical oil-derived advantage. On April 25th, it announced an ambitious policy, Vision 2030, which aims to diversify the national economy, boost growth, and decrease domestic unemployment.

In Syria, the alliance of Bashar al-Assad, Russia, and Iran remains on the front foot and pro-Saudi rebels opposed to it have experienced several setbacks. The Saudi goal of installing a sympathetic Sunni regime in Damascus has effectively been quashed in light of Russian involvement. Iran’s primary Middle Eastern ally is therefore likely to survive in some form. This will allow Tehran to continue with its own foreign policy goals, namely maintaining access to the eastern Mediterranean, extending influence near Israel, and balancing against Sunni-dominated states. Civil unrest also persists in Saudi Arabia’s unstable and predominantly Shiite eastern regions and Bahrain, albeit at low levels. This could be a soft point for Iran to exploit in the future. In Iraq, Iranian influence over the state is near complete and it continues to support a low-level military contingent.

Saudi Arabia will likely continue attempting to navigate out of costly conflicts in the region and countering Iranian influence over the next year. Given the cost of any direct conflict on its faltering economy, the options remain largely limited to diplomatic maneuvers. Its recent track record in this area is not great, however. In the fallout from the killing of Shiite cleric Nimr al-Nimr in early January, Riyadh and its allies cut diplomatic ties with Tehran, designated the pro-Iran Hezbollah a terrorist organization, and closed air routes to and from Iran. These achieved only limited success and may well backfire in the future. This is particularly likely in Lebanon, where Hezbollah could retaliate against Saudi allies in the government.